Curious about the booming sugar industry in Bangladesh? The industrial sugar market in Bangladesh is witnessing remarkable growth, driven by escalating demand from the food and beverage, pharmaceutical, and confectionery sectors. Valued at approximately USD 1.2 billion in 2022, the market is projected to grow at a compound annual growth rate (CAGR) of around 6% from 2023 to 2028. Understanding this growth is crucial for stakeholders looking to capitalize on emerging opportunities. This article delves into the key factors behind this growth, the major players, import-export dynamics, and the challenges and opportunities facing the market.

Overview of the Industrial Sugar Market in Bangladesh

The industrial sugar market in Bangladesh is experiencing robust growth, driven by escalating demand from various sectors. Valued at approximately USD 1.2 billion in 2022, the market is expected to expand at a compound annual growth rate (CAGR) of around 6% from 2023 to 2028. This surge is largely fueled by the food and beverage industry, which consumes a significant portion of industrial sugar for manufacturing soft drinks, juices, and other products. The pharmaceutical sector also contributes to this demand, utilizing high-quality sugar in medicinal syrups and tablets. Additionally, the confectionery industry, encompassing a wide range of sweets and chocolates, relies heavily on industrial sugar. The dairy and bakery sectors further amplify the market’s expansion, with sugar being a critical ingredient in numerous products.

- Food and Beverage

- Pharmaceuticals

- Confectionery

- Dairy Products

- Bakery Items

Key Players in the Bangladesh Sugar Market

Key players in the Bangladesh sugar market hold significant sway over the production and distribution landscape. Their operations not only ensure a stable supply of industrial sugar but also drive innovations and efficiency in the industry.

- Deshbandhu Sugar Mills Ltd.

- City Group

- Meghna Group of Industries

- Abdul Monem Ltd. These companies dominate the market with their extensive production capacities and distribution networks. Deshbandhu Sugar Mills Ltd. is renowned for its high-quality sugar products, while City Group and Meghna Group of Industries leverage their diverse portfolios to maintain market leadership. Abdul Monem Ltd. contributes significantly by focusing on both local and international markets, thereby ensuring a robust supply chain.

Import and Export Dynamics in the Industrial Sugar Market

The import of industrial sugar into Bangladesh has been on a consistent upward trajectory. In 2022, the country imported approximately 1.8 million metric tons of industrial sugar to fulfill its domestic demand. This significant volume underscores the critical role imports play in maintaining the supply chain for various industries reliant on sugar, such as food processing, pharmaceuticals, and confectionery. The reliance on imported sugar ensures that the domestic market can meet its production requirements without facing severe shortages.

| Exporting Country | Import Volume (Metric Tons) | |—|—| | Brazil | 800,000 | | India | 600,000 | | Thailand | 200,000 | | Others | 200,000 |

Brazil and India are the predominant exporters of raw sugar to Bangladesh, with Brazil leading the charge by exporting about 800,000 metric tons in 2022. India follows closely, supplying around 600,000 metric tons. Thailand also contributes significantly, although to a lesser extent, with exports totaling 200,000 metric tons. Other countries collectively account for an additional 200,000 metric tons. These figures highlight the diversified sourcing strategy adopted by Bangladesh to mitigate risks associated with dependency on a single supplier.

Looking ahead, the trends suggest a continual increase in sugar imports, driven by the growing demand across various sectors. The future outlook indicates that Bangladesh might explore new trade partnerships and diversify its import sources further to ensure a stable supply. Additionally, improvements in infrastructure and logistics are expected to streamline the import process, reducing costs and enhancing efficiency. The focus will likely remain on balancing import volumes with domestic production capabilities to stabilize market prices and ensure consistent availability.

Government Policies and Their Impact on the Sugar Market

Government policies and tariffs are pivotal in shaping the industrial sugar market in Bangladesh. Current policies aim to bolster local production while ensuring a steady supply of raw sugar through imports. Recent reductions in import tariffs have significantly facilitated easier access to raw sugar, directly benefiting local manufacturers by reducing input costs. This policy shift is designed to stabilize the market, ensuring that domestic industries reliant on sugar can operate without facing supply constraints. Additionally, the government has initiated efforts to enhance local sugar production capabilities, focusing on self-sufficiency and reducing dependency on imports.

- Reduction in import tariffs

- Subsidies for local production

- Environmental regulations The reduction in import tariffs has led to a more competitive market landscape, making it easier for manufacturers to obtain raw sugar at lower costs. Subsidies for local production are encouraging investment in sugar mills and refining infrastructure, further boosting the domestic supply chain. Environmental regulations are also becoming more stringent, pushing companies to adopt sustainable practices and eco-friendly production methods. Overall, these policies are creating a balanced approach, promoting both local production and efficient import practices while ensuring environmental sustainability.

Challenges and Opportunities in the Industrial Sugar Market

Challenges in the industrial sugar market in Bangladesh primarily stem from fluctuating global sugar prices, which significantly impact import costs. This volatility can lead to unpredictability in pricing for local manufacturers, making it difficult to maintain cost-effective production. Additionally, the infrastructure required to support efficient distribution of industrial sugar remains inadequate. This includes storage facilities, transportation networks, and processing plants, which need substantial improvements to ensure a smooth supply chain and minimize losses during transit.

- Expanding food processing industry

- Increasing pharmaceutical applications

- Technological advancements in sugar refining

- Sustainability practices

Opportunities for growth in the industrial sugar market are abundant. The expanding food processing industry is a significant driver, with increasing demand for sugar in manufacturing beverages, confectioneries, and other processed foods. Pharmaceutical applications of sugar are also on the rise, as high-quality sugar is essential for producing syrups, tablets, and other medicinal products. Technological advancements in sugar refining offer another avenue for growth, enabling more efficient production processes and higher quality outputs. Furthermore, sustainability practices are becoming increasingly important, with companies investing in eco-friendly production methods to reduce their carbon footprint and meet regulatory standards.

By capitalizing on these opportunities, businesses can navigate the challenges of the market more effectively. Investing in advanced technologies can enhance production efficiency and product quality, while expanding into the pharmaceutical sector can open new revenue streams. Embracing sustainability practices not only aligns with global environmental trends but also positions companies as responsible and forward-thinking, potentially attracting more customers and investors.

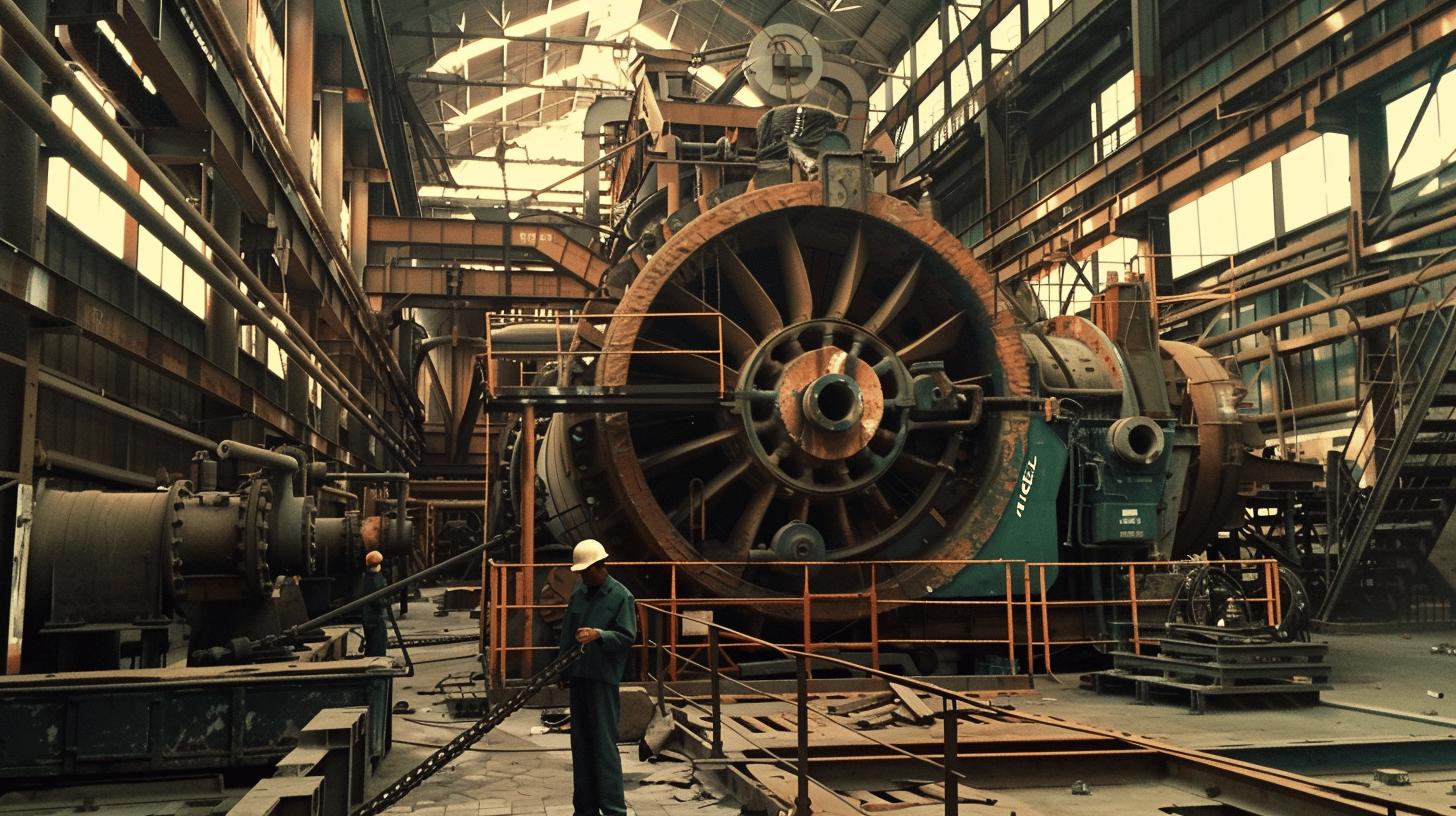

Technological Advancements and Sustainability in Sugar Production

Recent technological advancements in sugar refining and processing have significantly enhanced production efficiency and product quality within the industrial sugar market in Bangladesh. Innovations such as automated refining processes and advanced filtration systems have streamlined operations, reducing manual labor and minimizing errors. These technologies enable higher precision in sugar crystallization and purification, resulting in a superior final product. Moreover, the integration of digital monitoring systems allows for real-time adjustments, optimizing the entire production cycle and ensuring consistent quality. Sustainability and eco-friendly practices are becoming increasingly crucial in the sugar industry due to rising environmental concerns. Companies are now investing heavily in green technologies to reduce their carbon footprint and comply with stringent environmental regulations. The adoption of renewable energy sources, such as solar and biomass, in sugar mills is a significant step towards sustainable production. Implementing waste management systems, including recycling and reusing by-products, further contributes to the industry’s environmental goals. These practices not only help in reducing pollution but also in conserving natural resources, promoting a circular economy.

- Automated refining processes

- Renewable energy sources

- Waste management systems

- Carbon footprint reduction initiatives The benefits of these technological advancements and sustainability practices are manifold. Automated refining processes increase operational efficiency, reduce costs, and enhance product quality. Renewable energy sources decrease reliance on fossil fuels, lowering greenhouse gas emissions and operational costs in the long run. Effective waste management systems mitigate environmental impact, turning waste into valuable resources. Carbon footprint reduction initiatives improve the industry’s overall sustainability profile, attracting eco-conscious consumers and investors. Collectively, these advancements position the industrial sugar sector in Bangladesh for long-term growth and environmental stewardship.

Final Words

The industrial sugar market in Bangladesh is thriving, driven by demand from sectors like food and beverage and pharmaceuticals. Key players like Deshbandhu Sugar Mills Ltd. and City Group dominate the market, while import dynamics are shaped by major exporters, including Brazil and India.

Government policies play a crucial role, with recent tariff reductions facilitating easier access to raw sugar.

Challenges like fluctuating global prices exist, but opportunities in expanding industries and technological advancements promise growth.

Businesses capitalizing on these trends can look forward to a prosperous future in the industrial sugar market in Bangladesh.

FAQ

What is the current size and growth rate of the industrial sugar market in Bangladesh?

The industrial sugar market in Bangladesh was valued at approximately USD 1.2 billion in 2022, with an estimated compound annual growth rate (CAGR) of around 6% from 2023 to 2028.

Which sectors are the primary consumers of industrial sugar in Bangladesh?

The primary sectors consuming industrial sugar include:

- Food and Beverage

- Pharmaceuticals

- Confectionery

- Dairy Products

- Bakery Items

Who are the key players in the industrial sugar market in Bangladesh?

Key players include Deshbandhu Sugar Mills Ltd., City Group, Meghna Group of Industries, and Abdul Monem Ltd. These companies dominate the production and distribution of industrial sugar in the country.

What are the import and export dynamics of the industrial sugar market in Bangladesh?

Bangladesh imported around 1.8 million metric tons of industrial sugar in 2022, primarily from Brazil and India. The country relies heavily on imports to meet domestic demand.

Which countries export the most sugar to Bangladesh?

The main exporters of sugar to Bangladesh are:

- Brazil: 800,000 metric tons

- India: 600,000 metric tons

- Thailand: 200,000 metric tons

- Others: 200,000 metric tons

How do government policies impact the sugar market in Bangladesh?

Government policies, including tariff reductions and subsidies, significantly shape market dynamics by facilitating easier access to raw sugar and supporting local production.

What recent government policy changes have affected the sugar industry?

Recent policy changes include:

- Reduction in import tariffs

- Subsidies for local production

- Environmental regulations

What are the main challenges faced by the industrial sugar market in Bangladesh?

The main challenges include fluctuating global sugar prices, impacting import costs, and the need for improved infrastructure for efficient distribution.

What opportunities exist for growth in the industrial sugar market in Bangladesh?

Key growth opportunities are:

- Expanding food processing industry

- Increasing pharmaceutical applications

- Technological advancements in sugar refining

- Sustainability practices

How are technological advancements and sustainability practices impacting the sugar industry?

Technological advancements enhance production efficiency and product quality, while sustainability practices focus on eco-friendly methods to reduce the carbon footprint and improve environmental impact.

What specific technologies and practices are being adopted in the sugar industry?

Specific technologies and practices include:

- Automated refining processes

- Renewable energy sources

- Waste management systems

- Carbon footprint reduction initiatives